The Weight of the Curve

The Weight of the Curve

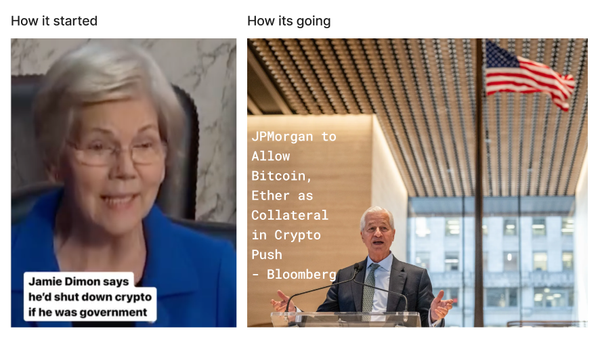

There’s been a lot made these past weeks about Fed independence, the path for short-term rates, the resilience of the U.S. economy, and what it all means for bitcoin. The overnight rate was cut 25 bps. There was a dissenting vote, plenty of takes that it should’ve been 50, and the usual parsing of dot plots and adjectives. The most interesting move to me wasn’t the fed funds print, it was the 30-year mortgage rate.

In a counterintuitive twist, the one rate that matters most for a broad swath of U.S. households rose by ~25 bps to 6.37%. Maybe the Fed sounded less dovish than the market wanted. Maybe it was a reset on labor or inflation expectations. Regardless, this is exactly why we’re building Lygos.

If rates are the headline. Balance sheets are the plot.

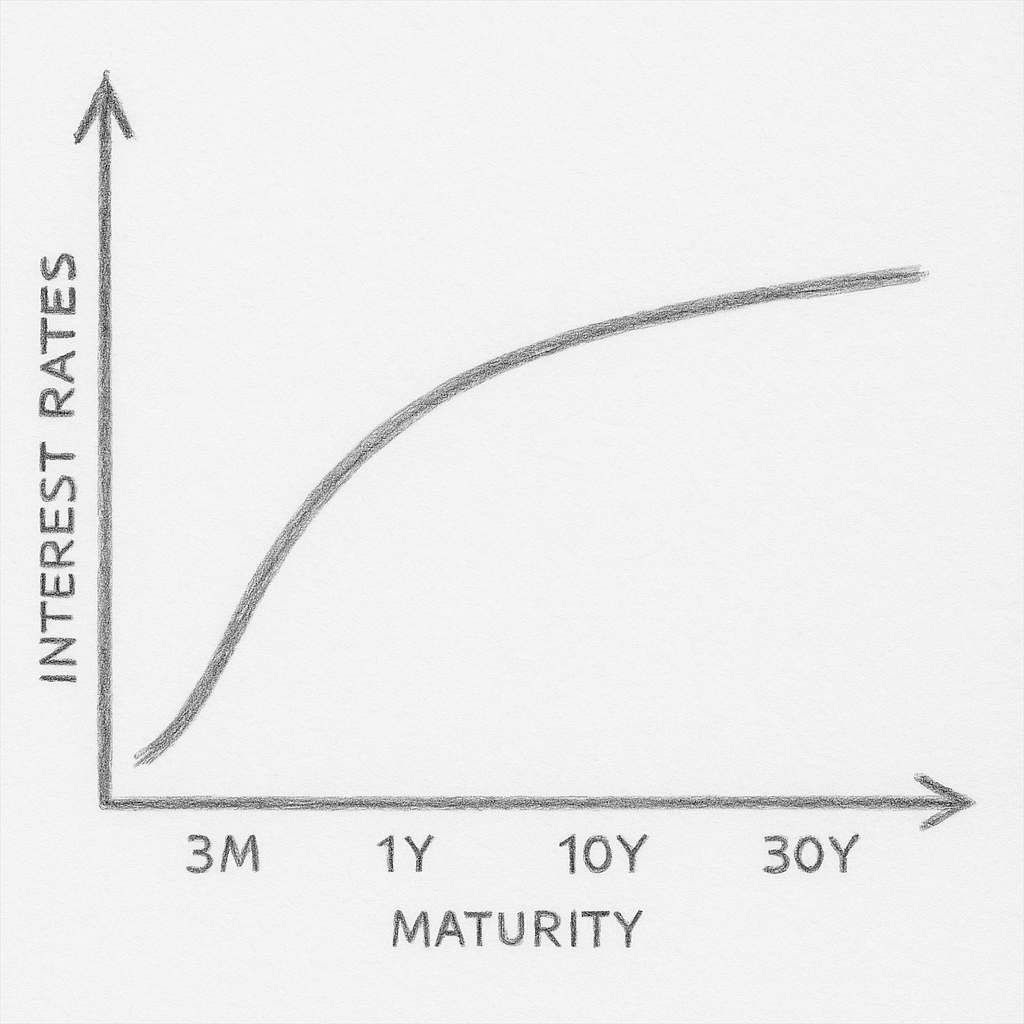

Everyone keeps saying higher policy rates killed housing demand and affordability. That may be directionally true, but it’s not the whole story. Interest rates live on a yield curve – from overnight to 30 years and beyond. The Fed moves the very short (near) end of that curve. The rest is set by investors’ expectations of the path of short rates over time, generally with an extra cushion (the term premium) for taking duration risk (the price sensitivity that grows the longer you lend). So a cut in the policy rate nudges the front end of the curve down; mortgage pricing is anchored in the belly and the long end (10+ years).

If you actually want to move mortgage rates down - and the long end more broadly - you don’t get there with 25bp moves on overnight rates. To pull that down, you need to shrink the term premium and artificially absorb supply (becoming the buyer).

Under the surface, we’re drifting back toward the same set of tools we’ve seen in past cycles: quantitative easing, yield-curve control, or some “fancy” Treasury-facility that nets out to the same. The vocabulary doesn’t really matter, form is secondary to function here. The function is simple: print dollars to move longer term rates where you need them.

Fiscal gravity didn’t go away. It just got heavier.

Fiscal gravity is governments’ tendency to spend beyond their means. The deficit is increasing at an increasing pace. We had a brief efficiency moment – doing more with less, squeezing costs, and pretending growth will outrun issuance. The effect of gravity can’t be outrun. Entitlement spending up, interest expense up, defense up, revenues turn down the moment growth cools. The result is a Treasury market that needs a steady, price-insensitive purchaser of long dated bonds.

And when the buyer of those bonds isn’t the free market but a central bank, the “risk-free rate” becomes a managed rate. Not risk-free.

The currency always pays.

If the path out of a debt burden is to “lower the cost of the debt by manipulating the curve,” you’re making a distributional choice: support asset prices today by taxing currency holders tomorrow. The cumulative effect is the same. Debasement.

Affordability doesn’t come from cheaper debt alone; it comes from real supply and real incomes. Monetary engineering can shuffle prices, but it can’t pour concrete, add workers, or raise productivity.

Bitcoin is the exit lane.

Bitcoin is, imperfectly but meaningfully, a market with fewer knobs to twist. Scarce digital capital with transparent rules. That matters when the unit of account you live in is being leaned on to solve problems that politics won’t.

This is the world we’re building for at Lygos: where bitcoiners can start and fund businesses, invest in their communities, and build the future through safe, trustless bitcoin-backed credit.

Where this goes

If you believe the deficit keeps compounding and the buyer of last resort (central banks) keeps growing, then long-term, the risk free nature of “risk-free” yields is compromised. In that world, financial assets can look fine until real returns are eaten by inflation or devaluation. Real assets with credible scarcity do better. Systems that minimize discretionary intervention do best.

None of this guarantees a straight line for bitcoin or for bitcoin-backed credit markets. It does, however, make the case for building alternative, trust-minimized credit now.