JPMorgan Accepts Bitcoin as Collateral: What It Really Changes

“JPMorgan to Allow Bitcoin and Ether as Collateral in Crypto Push”

Friday's Bloomberg headline generated significant buzz. The crypto community has a tendency to grab a headline and run with it, but in this case, much of the excitement was warranted.

The Winding Path Here.

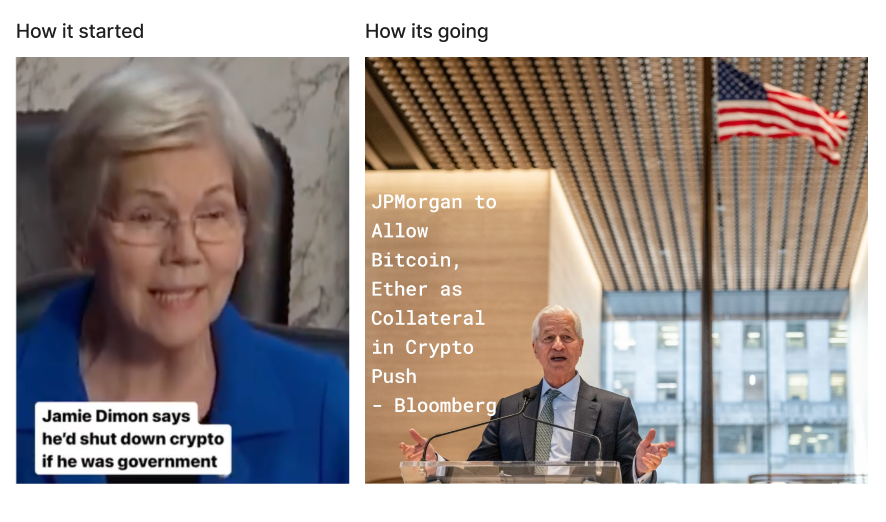

Less than 2 years ago, Jamie Dimon said in congressional testimony, "I've always been deeply opposed to crypto, Bitcoin, etc… If I were the government I'd close it down." The bank’s recent shift, first with margining IBIT, then the “debasement trade” has been just one example of legacy financial institutions being pulled into Bitcoin. This isn’t an overnight change and certainly not the first time large banks have proclaimed they are entering the space but the conditions are different.

JPMorgan’s first foray into the space began as early as 2021 (where as an analyst, yours truly attempted to explain how blockchains worked to MD’s who couldn't care less, in a largely performative exercise). I saw the other side of those efforts at Anchorage where we engaged many of the largest banks in developing and launching collateralized lending products. A process that spanned many months, in some cases years, meticulously analyzing and explaining each operational and technical step to dozens of stakeholders.

All to say that these things do not happen overnight, they take years. The price action over the last year was certainly not the tipping point, but the regulatory and political environment likely were. These tides can and do shift though, remember Goldman Sachs (who I expect to launch a competing product to JPM) extended a very similar BTC collateralized loan to Coinbase in 2022. I am optimistic that this will be a more permanent step, and see it as a great accelerant to our business here at Lygos for a number of reasons.

The Great Unlock... or Not

First, I’ll note three things:

- This product at least to start is a custodial, institutional product where collateral is held at a regulated third party custodian.

- JPMorgan and other prime brokers already accept Bitcoin ETFs as margin in various forms.

- Large institutional clients can already access competitive credit from the likes of Cantor, Galaxy, Tether, and others under similar structure (likely less onerous terms).

Okay, but JPMorgan is not Tether, they are the largest most reputable bank in the world. True. Large institutional clients have portfolios of equities and derivatives that would benefit from increased capital efficiency using Bitcoin as collateral. Also true.

To the first, I’d argue that the scale of the client that we are talking about here (above $25mm) can already access credit via risk-mitigated tri-party products. Is JPMorgan holding onto my bitcoin better than Tether holding on to it? Maybe. Is Anchorage or Copper holding it in triparty ,where you borrow from Galaxy, better than holding it in JPMorgan’s name? Probably.

As for capital efficiency, these are still just isolated collateralized loans. Post bitcoin as collateral, get dollars in return. Portfolio margin and cross-collateralization drive capital efficiency, not isolated leverage. Equity swaps offsetting margin requirements for my options positions, or spot holdings margining a futures position. True capital efficiency will require changes to margin rules by exchanges and clearing organizations. Until then, IBIT is much more capital efficient than holding spot and borrowing.

The Tipping Point

The direct beneficiaries from large banks offering these products to large customers is limited, but there is a validation signal, easing reputational and operational concerns for the rest of the market. Now that the first move has been made, local and regional banks, private lenders, and others will quickly follow. Most don’t have the consensus of committees and years long process that large national banks do. They have the ability to move fast, introduce more creative and flexible structures, and expand the reach of bitcoin-collateralized credit to the masses.

The next five years will see an explosion of bitcoin-collateralized offerings to individuals, businesses, and institutions alike. Standard bitcoin-backed loans, but also revolving lines of credit, bitcoin credit enhancements, term financings, letters of credit, and more.

Where do smaller lenders fit in? The Trump administration and Treasury Secretary Bessent have been persistent in their messaging that they want Main Street to drive economic investment and restore the American Dream. This includes tactical changes to regulation and enforcement that place an emphasis on how community banks are impacted. Whether you agree with this vision, or its likelihood of success, one thing is clear. Credit creation by Main Street lenders is set to balloon and Bitcoin will buoy that growth.

Long term financing structures where bitcoin replaces traditional cash equity, pioneered by Battery Finance, make all too much sense. Better returns, lower risk, and an alignment of interests stronger than traditional debt financing.

A Win Win

There is a missing puzzle piece here. Main street lenders are generally not in the business of tracking collateral that trades 24/7, and certainly not safekeeping it. Custody is an unnecessary risk for both parties involved. Unlike lenders of bitcoin past, these new lenders have more permanent capital bases, with no need to rehypothecate or trade the underlying collateral. Large banks like JPM, Goldman, and Citi will manage monitoring, liquidating, and custodying collateral (whether directly or indirectly), however for most it is not feasible.

On the other hand, many borrowers will prefer the flexibility and personal relationships working with community banks and private lenders affords them, however they will certainly be more wary of their own counterparty risk following the failures of 2023. This is the future we are building for at Lygos. A solution where borrowers don’t need to underwrite lenders, and lenders can avoid much of the operational and technical risk associated with taking bitcoin as collateral.

This isn’t a tradeoff either. Borrowers benefit from the risk mitigation of a non-custodial bitcoin native solution. Lenders benefit from having the operational and technical aspects of monitoring, liquidation, and safeguarding collateral abstracted away from them. Bitcoin-native, non custodial lending isn’t a compromise, its a win-win.